In Manhattan Real Estate, Cash Is Everything

Across the country, buying a home in cash is increasingly common. In Manhattan, it’s become the standard.

In April, buyers paid entirely in cash for 64 percent of the homes sold in Manhattan, according to Marketproof, a provider of New York City real estate data. In contrast, cash buyers accounted for 39 percent of April sales in large U.S. metro areas, according to ATTOM, which provides national real estate data. (Manhattan was a similar outlier even within New York City.) The gap between Manhattan and the rest of the country has grown since 2022, when interest rates first spiked, making cash a more attractive option for those who have plenty of it.

In New York, “cash buyer” might bring to mind an oligarch who parks millions in a palatial apartment that sits empty most of the year. But a New York Times analysis of recent sales paints a far more expansive portrait.

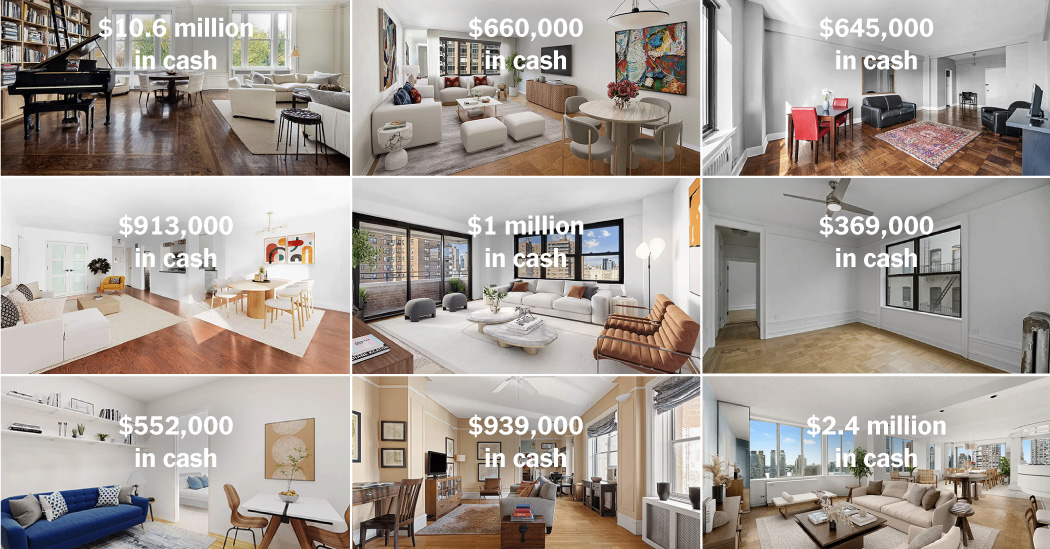

Over two days in February, 52 of the 76 closings were in cash. Interviews with 28 buyers on those days and some of their agents, as well as a review of public records, revealed that the people paying cash were mostly American and often New Yorkers. They worked in health care, tech, fashion and the arts. Their ages spanned from the late 20s to the 80s. They got the cash by selling stock or a previous home, or from their parents, or from years of saving. The places they bought touched every corner of Manhattan, from the city’s most exclusive condos to its most affordable co-ops.

Notably, the highest rate of growth in cash purchases from 2021 to 2023 was among apartments under $3 million. For most Americans, spending even $1 million for an apartment may sound like an eye-popping sum, but the median sales price in the borough was $1.1 million in April, according to StreetEasy. Most of the apartments sold on Feb. 13-14 were listed for well under $1 million — the cheapest cash closing was a $250,000 studio.